Small Business Distress in 2025: What Subchapter V Bankruptcy Filings Reveal

Unlike surveys or sentiment indexes, bankruptcy filings represent concrete decisions made under financial pressure.

In 2025, many small business owners found themselves navigating decisions that felt heavier than expected. At Starcycle, we spend a lot of time speaking with founders and operators who are trying to understand whether their challenges are isolated or part of something broader. One of the clearest ways to answer that question is by looking at bankruptcy data, especially filings designed specifically for small businesses.

This post looks closely at Subchapter V bankruptcy filings in 2025. The goal is not to dramatize the numbers or draw sweeping conclusions, but to explain what the data shows, how it changed month by month, and what it can tell us about the operating environment small businesses faced throughout the year.

Why Bankruptcy Filings Are a Useful Economic Signal

Bankruptcy filings are a lagging indicator. They reflect conditions that have already been unfolding for months. By the time a business files, revenue pressure, debt constraints, and operational stress have usually been present for some time.

That is precisely why this data is useful. Unlike surveys or sentiment indexes, bankruptcy filings represent concrete decisions made under financial pressure. They do not capture every struggling business, but they do capture moments when stress became impossible to manage informally.

In 2025, bankruptcy filings provided a grounded view of how long volatility persisted and when it reached a breaking point for many small businesses.

What Is Subchapter V Bankruptcy?

Subchapter V is a form of Chapter 11 bankruptcy designed specifically for small businesses. It was created to make reorganization more accessible and less costly for companies that do not have the resources to pursue a traditional Chapter 11 case.

Subchapter V allows eligible businesses to restructure debt while continuing operations. It simplifies certain procedural requirements and is generally faster than a standard Chapter 11 process.

Why Subchapter V Matters for Small Business Analysis

Because Subchapter V is more accessible, it captures a segment of the business population that might otherwise avoid formal restructuring. That makes it a useful indicator of stress among small and mid-sized businesses, not just large enterprises.

When Subchapter V filings rise, it suggests that pressure has reached a level where informal adjustments are no longer sufficient for a growing number of operators.

The Monthly Subchapter V Filing Trend in 2025

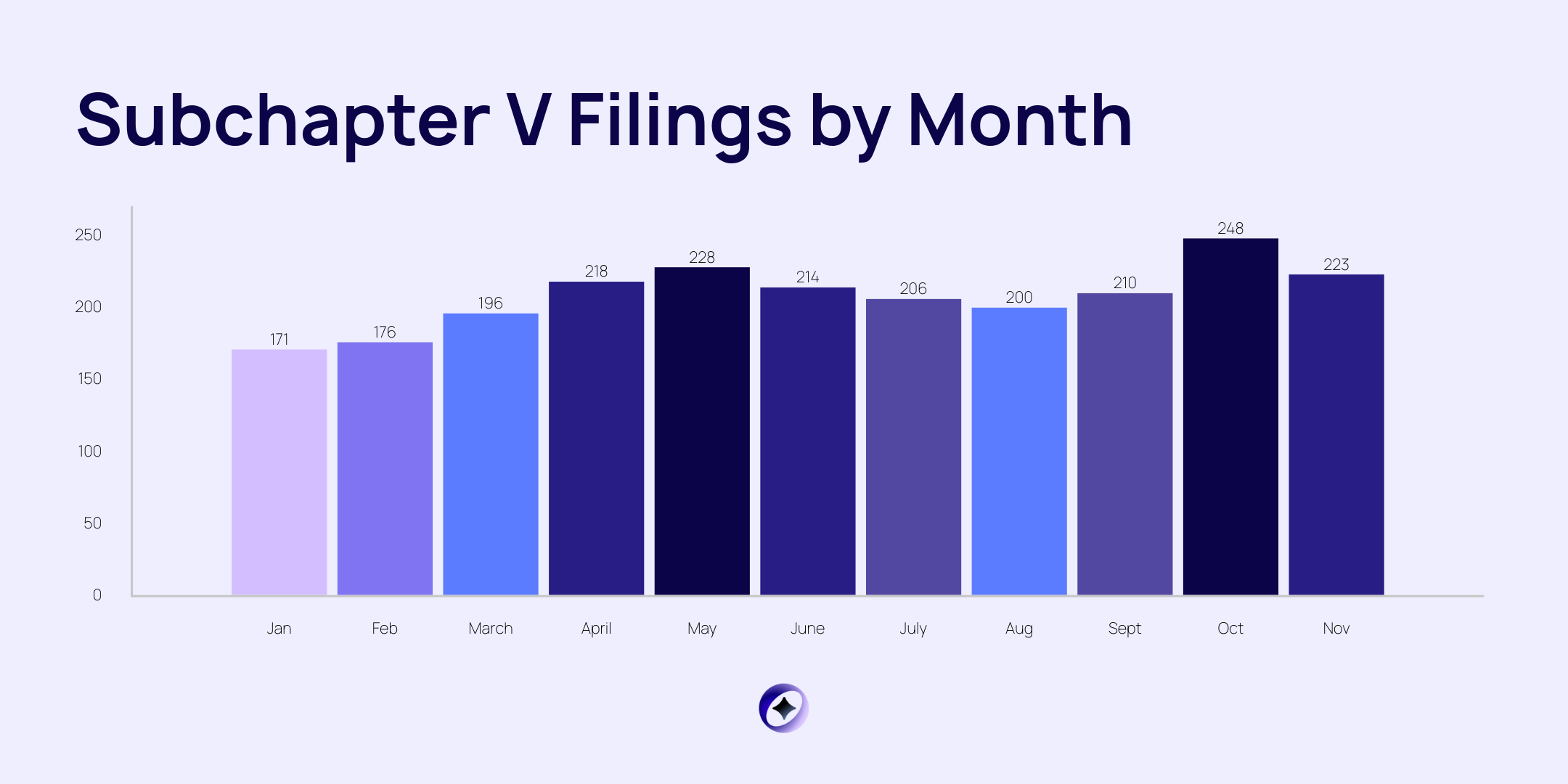

From January through November 2025, Subchapter V filings showed a clear pattern.

The year began with moderate filing levels, followed by a steady increase through the spring. Filings peaked in October at 248, the highest monthly total of the year. November remained elevated compared to early 2025.

This pattern suggests that stress accumulated over time rather than emerging suddenly. Even as some economic indicators improved midyear, filings continued to rise later in the year.

How Subchapter V Compared to Commercial Chapter 11

Comparing Small Business and Broader Corporate Distress

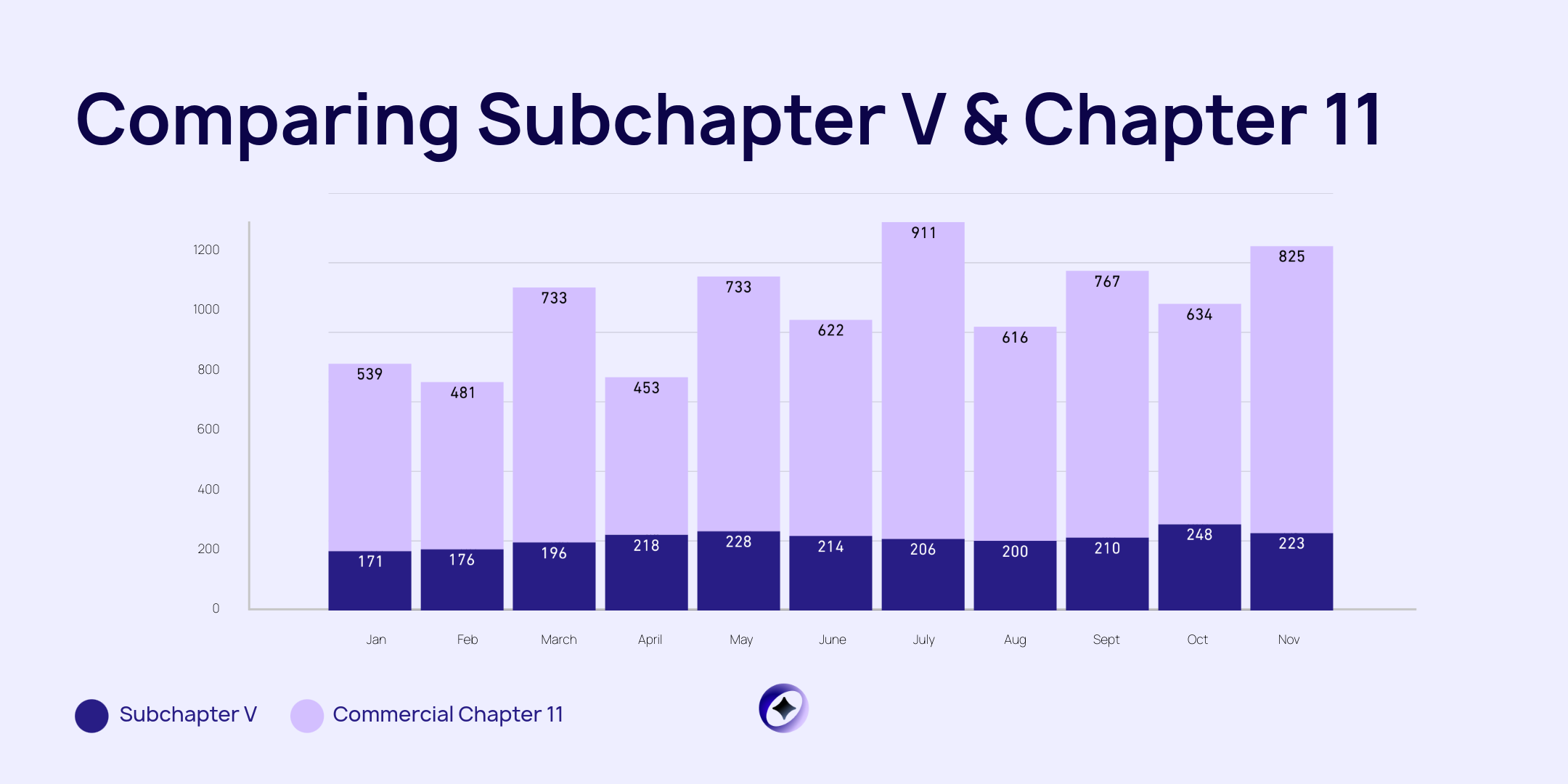

Looking at Subchapter V filings alongside commercial Chapter 11 filings helps put small business stress in context.

From January through November 2025:

- Subchapter V filings totaled 2,285

- Commercial Chapter 11 filings totaled 6,895

Commercial Chapter 11 filings peaked earlier in the year, reaching a high of 911 in July. Subchapter V filings peaked later, in October.

This timing difference matters. It suggests that larger or more complex businesses encountered acute stress earlier, while small businesses continued absorbing pressure before filing later in the year.

Timing and Economic Conditions in 2025

Linking Filings to Broader Indicators

The rise in Subchapter V filings aligns with other trends observed in 2025.

Consumer confidence declined again from September through November, falling to 88.7 by November. Consumer sentiment reached its lowest point of the year in November as well.

Unemployment rose steadily throughout the year, increasing from 4.0 percent in January to 4.6 percent by November. Interest rates remained elevated for most of the year, only easing late in 2025.

Together, these conditions point to sustained demand softness and limited financial flexibility. Subchapter V filings peaked after months of pressure, not during short-term downturns.

What Subchapter V Filings Tell Us About Small Business Stress

What the Data Shows Clearly

The 2025 Subchapter V data supports several conclusions.

First, financial stress among small businesses was persistent. It did not disappear after brief improvements in confidence or inflation.

Second, pressure built gradually. Filing activity rose through the spring, moderated slightly in summer, and then increased again in the fall.

Third, late 2025 conditions were materially more challenging than midyear indicators alone might have suggested.

What the Data Does Not Show

It is equally important to understand the limits of this data.

Subchapter V filings do not capture businesses that closed informally or wound down voluntarily. They do not represent all struggling companies, and they do not imply that every filing business failed.

They also do not explain why individual businesses filed. Each case reflects a unique combination of factors.

Subchapter V Filings Within a High Churn Economy

Bankruptcy data needs to be viewed alongside broader business activity.

In November 2025, there were 535,041 new business applications in the United States. From those applications, approximately 31,434 new employer businesses are expected to form within four quarters.

At the same time, more than 15,000 retail store closures were projected for the year. Large chains accounted for a significant share, including hundreds of closures by well-known retailers.

This combination points to an economy with high activity and high turnover. New businesses continued to launch, while existing businesses faced sustained pressure.

Why This Matters for Small Business Owners

Practical Insights from the Data

Subchapter V filings offer a grounded way to understand risk and timing.

They show that financial stress often becomes visible only after extended periods of difficulty. They also highlight that late-year conditions can be more severe than midyear rebounds suggest.

For business owners evaluating their own situation, this data provides context. It helps answer whether challenges are isolated or consistent with broader trends affecting peers across industries.

Looking Ahead Using What 2025 Revealed

What the Filing Trend Signals Going Forward

The late-year increase in Subchapter V filings suggests that volatility and demand softness had lasting effects in 2025. Short-term improvements did not erase accumulated pressure.

For planning purposes, this reinforces the importance of monitoring lagging indicators alongside leading ones. Bankruptcy filings confirm conditions after they have already influenced decisions, but they provide clarity that sentiment alone cannot.

Understanding these patterns does not simplify decision-making, but it does make the environment easier to interpret.

A Closing Note from Starcycle

At Starcycle, we often meet founders and small business owners at moments when numbers stop lining up with expectations. Sometimes that moment comes after months of trying to adapt quietly. Sometimes it arrives suddenly, even when the effort has been constant.

The Subchapter V data from 2025 reflects many of those stories. Not dramatic failures, but sustained pressure that eventually required a different kind of decision. Understanding that context matters, especially in a year where volatility made outcomes feel personal even when they were widely shared.

How a business ends or changes course is part of its story, not the end of it. Clear information creates space for better decisions, cleaner transitions, and the ability to move forward without carrying unresolved weight.

If 2025 forced hard choices, the data shows you were not alone. And when it is time to think about next steps, closing one chapter with clarity can make the next one easier to begin.